Accurate estimating is one of the most crucial aspects of your business if you are in the HVAC market. After all, if you can’t accurately estimate a work, you won’t make any money! There are numerous aspects that go into an estimate, and it can be difficult to keep track of them all. This is when HVAC Takeoff Services come into play. These services can eliminate all uncertainty from the estimation process, allowing you to focus on other aspects of your business. In this article, we will discuss the advantages of using HVAC Takeoff Services. We will also provide you with guidance on how to find the perfect service for your business.

What is HVAC estimating?

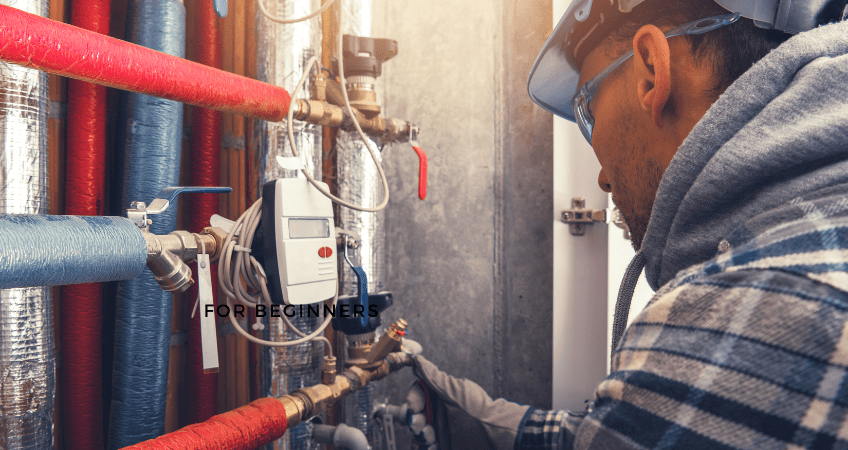

An HVAC Takeoff Services is a cost estimate for installing or maintaining a heating, ventilation, and air conditioning (HVAC) system. Typically, estimates are determined by the type and size of the system, the location, and the complexity of the task.

Our HVAC estimate scope includes:

- Mixed-air plenum and outdoor air control Estimate

- Air filter Estimate

- Supply fan Estimate

- Exhaust or relief fans and an air outlet Estimate

- Outdoor air intake Estimate

- Ductwork Estimate

- Terminal devices Estimate

- Return air system Estimate

- Heating and cooling coils Estimate

- Self-contained heating or cooling unit Estimate

- Cooling tower Estimate

- Boiler Estimate

- Control Estimate

- Water chiller Estimate

- Humidification and dehumidification equipment Estimate

- Pumps & Piping Estimate

Benefits of hiring an HVAC estimator

The HVAC takeoff is crucial since it commonly sets the quantity and unit of measure for labor and contractor equipment costs. There are numerous advantages to utilizing an HVAC estimator for your projects.

- An HVAC estimator can save you time and money by providing an accurate estimate of the cost to install or repair your HVAC system,

- This estimate includes the costs of materials, labor, and other unexpected expenses.

- In addition, an HVAC estimate may help you avoid future problems by detecting concerns that could lead to an increase in project costs. Get More Information About HVAC Estimation

3-step HVAC estimating process

If you require HVAC estimation services, there are several procedures you must do. Here is a three-step method for preparing the most precise estimate possible:

- Organize yourself: Before beginning the estimation procedure, it is essential to organize your paperwork. This includes your building drawings, utility bills, and any other relevant documentation. Having everything in order will make the estimation process much more efficient.

- Be aware of your loads: To correctly estimate your HVAC requirements, you must determine the heat load (BTUs per square foot) and cooling load of your building (tons). These values will assist in determining the required size and kind of HVAC system.

- Utilize quality software: There are numerous software applications that can help with HVAC estimation. Choose one that has a solid reputation and is simple to use. This will make the entire estimation process simpler and quicker.

How to prepare a perfect HVAC estimate?

As a heating, ventilation, and air conditioning (HVAC) contractor, you understand that providing accurate estimates is crucial to winning work and maintaining a profitable business. The estimation of HVAC tasks can be difficult, but with careful planning and execution, you can confidently present bids that will win your business.

Here are some tips for creating a perfect HVAC estimate:

- Collect the necessary information: To acquire an accurate estimate, you will need to collect complete project information. This covers the project requirements, blueprints, and any other relevant documentation. If you lack the relevant information, contact the contractor or project manager to obtain it.

- Take measurements: Once you have gathered all the essential information, carefully measure the space that requires heating or cooling. This can be done using the latest takeoff software like Planswift. This will guarantee that the correct equipment size is calculated for the project.

- Investigate prices To create an accurate estimate, it’s crucial to know how much supplies and equipment will cost. Research current rates for everything from ducting to compressors in order to include these expenses in your bid.

- Create a thorough estimate: After gathering all of the information and taking the necessary measurements, you are ready to create your estimate. Outline the supplies and labor required to complete the project. Then, total the prices of each item.

why you should choose us for your HVAC estimates?

The best HVAC estimator evaluates the proposed heating, ventilation, and air conditioning project’s scope to prepare a precise cost estimate. As an HVAC estimator, you calculate labor and material costs and determine the requirements of the project. Thankfully, we are capable of doing it better than others and will help you win more jobs!

If you are looking for an HVAC contractor to provide you with a project estimate, you should strongly consider using our estimating services. Here are a few reasons:

- We have an experienced staff of estimators who have worked on several HVAC projects. This means that we will be able to quickly and properly estimate the requirements of your project and offer you a detailed quote.

- We employ cutting-edge technology to generate our estimates, so you can rest assured that you are receiving an accurate picture of the expenses associated with your project.

- Our estimate services are priced competitively, so you can rest assured that you are receiving value for money.

- Throughout the estimation process, we will work closely with you to ensure that we thoroughly comprehend your needs and expectations. This allows us to adapt our estimate to your exact requirements.

- After providing you with an estimate, we will coordinate with you to arrange the completion of the work. We understand that HVAC projects are sometimes time-sensitive, therefore we will do everything possible to meet your timetable.